Where Kenya’s Top CEOs Get Their Business Funding

Share

The Central Bank of Kenya (CBK) has revealed where Kenya’s top Chief Executive Officers (CEOs) get their business funding in the new survey.

The CEO survey that was conducted in September 2025 highlighted the financing trends and credit accessibility among businesses in the third quarter of 2025.

CBK said most firms across the country rely heavily on their own resources and bank loans to fund their operations.

“Survey assessed the situation regarding ease of access to credit to find out whether banks were transmitting the benefits of the lower rates to their customers, in line with the lowering of the Central Bank Rate (CBR) by the Monetary Policy Committee of the Central Bank of Kenya since August 2024,” read part notice.

Also Read: Good News for Borrowers as Central Bank Lowers CBR by 25 Basis

Details Inside New Report Where CEOs Get Funding

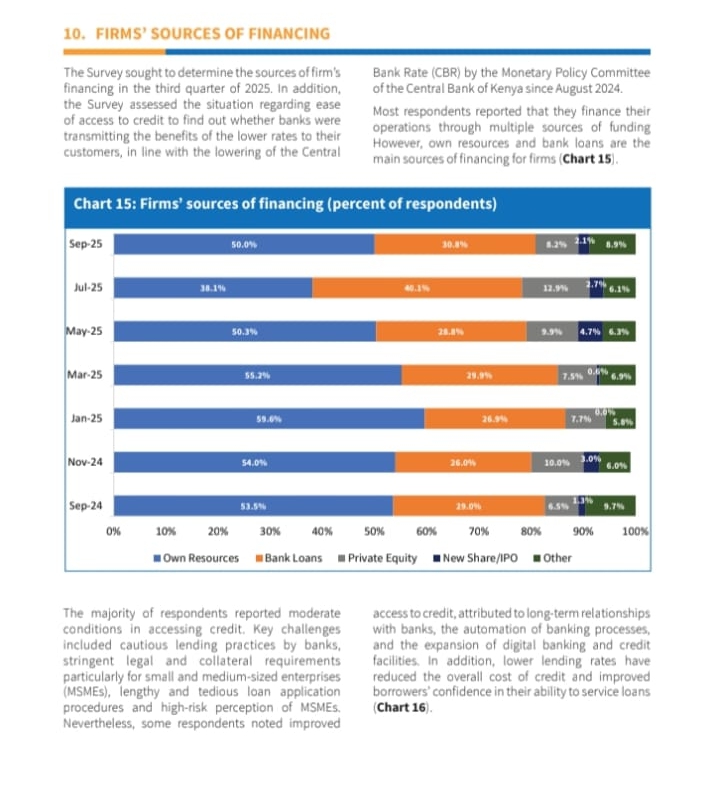

The report states that 50% of firms heavily rely on their own resources as their main source of funding, while 30.8% depend on bank loans.

On the other hand, 8.2% depended on private equity, 2.1% on new share/IPO, and 8.9% on other financing options.

According to the report, funding options remain internal financing despite various financing options among Kenyan firms.

Additionally, the report highlights fluctuating patterns from September 2024, whereby 53.5% firms relied on their own resources.

In January 2025, the figures rose to 59.6% and later depreciated to 50% in September 2025.

The report showed how bank loans increased from 26% in November 2024 to 46.3% in July 2025 before dropping in the latest quarter of the year.

Challenges Encountered During the Loan Application Process

The credit side showed that the majority of respondents reported moderate conditions, highlighting challenges like high collateral demands, strict lending practices by banks, and a lengthy loan application process.

Small and medium-sized enterprises (MSMEs) were particularly affected due to banks’ high-risk perception of the sector.

Also Read: CBK Creates a New Centre for All Banks

Positive Developments From Firms Accessing Business Funding

Due to improved access to credit for some firms, it has encouraged long-term relationships between firms and banks through the adoption of digital banking systems.

Additionally, CBK revealed that the lowering of CBR since August 2024 reduced the cost of borrowing and boosted firms’ confidence to service loans.

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

Photo Showing Where firms in Kenya gets Business funding from. PHOTO/CBK Screenshot