Share

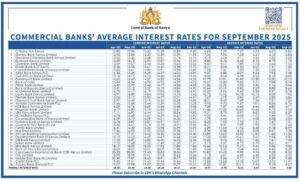

The Central Bank of Kenya (CBK) has released the Commercial Banks’ Average Interest Rates Report for September 2025, providing a detailed breakdown of lending and deposit rates across the country’s major financial institutions.

The report offers crucial insights for borrowers and savers, showcasing how different banks are pricing credit in the face of economic shifts and monetary adjustments.

According to the CBK data, the overall average lending rate among commercial banks in Kenya stood at 15.07%, slightly lower than August’s 15.17%, indicating a marginal easing in credit costs.

The average deposit rate dropped to in September 7.63%, down from 7.74% in the previous month.

Also Read: CBK Explains Why Global Oil Prices Increased This Week

Citibank, Stanbic, and Standard Chartered Lead with Lowest Rates

From the data, Citibank N.A. Kenya emerged as the bank with the lowest lending rate in September 2025, standing at 9.60%, followed closely by Stanbic Bank Kenya at 11.96%, and Standard Chartered Bank Kenya at 13.27%.

Other banks offering relatively low rates include Ecobank Kenya at 13.50% and Guardian Bank at 13.73%.

Also Read: Fake SHA Officials Arrested for Conning Man KSh251,000

Smaller Banks Maintain Higher Lending Margins

Conversely, smaller and mid-tier banks continued to charge higher lending rates.

Access Bank Kenya posted the highest rate at 19.49%, while Credit Bank PLC and Middle East Bank Kenya followed closely with 19.41% and 18.86%, respectively.

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

CBK Reveals Banks With Lowest Interest Rates in October 2025. PHOTO/ CBK

You Might also Like