Manufacturers to Pay Up to KSh4 Million in Annual Standards Levy

Share

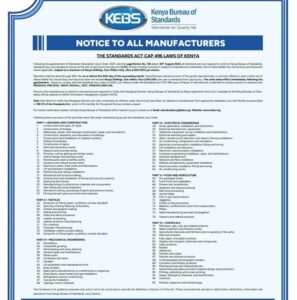

Following the gazettement of Standards (Standards Levy) Order 2025 vide the Legal Notice No. 136 dated 08 August 2025, all manufacturers are required to remit to Kenya Bureau of Standards, standards: levy, recoverable at source, at the rate of zero point two percent (0.2%) of thee monthly turnover in respect of manufacture undertaken, Net of Value Added Tax, Excise Duty and Discounts where applicable, subject to a maximum of Ksh4,000,000 per annum.

Payments shall be made through KRA iTax on or before the 20th day of the succeeding month.

Manufacturers whose turnover of the goods manufactured, or services offered in each month, net of Value Added Tax, Excise Duty, and discount, does not exceed Ksh5,000,000 per year, are exempted from paying the levy.

The order takes effect immediately following the gazettement. Failure to comply with the Standards Levy Order of 2025 is an offence under the Standards Act, CAP 496, laws of Kenya. A manufacturer is defined to include a person or persons who produce, process, treat, install, test, operate, and use.

Persons who manufacture or intend to manufacture are required to notify the Managing Director, Kenya Bureau of Standards, by filling registration forms SL/1 available at the Kenya Bureau of Standards official website on the KEBS Information Management System (KIMS)

Note that failure to notify the Managing Director not only constitutes an offence under the Act but also does not absolve a manufacturer from paying the standards Levy and Penalty as prescribed in 108 (3) of the Standards Act, which is 5% monthly for the period the levy remains unpaid

For further clarification, please visit any Kenya Bureau of Standards office nearest to you or email us at Email: standardslevy@kebs.org; Website.

The following are some of the activities that fall under manufacturing as per the Standards Levy Order

PART I-Building and Construction

1 Construction and repair of roads

2. Construction of bridges.

3. Waterways, sewer,s and drainage construction, repair, and renovations

4 Construction, alteration, and renovation of buildings

5 Construction and installation of irrigation systems.

6. Construction of dams

7. Earth and excavation works

8. Drilling of boreholes

9. Masonry and concrete works.

- Roofing, glazing, and timber works

- Interior design and painting works. 12. Plumbing and waterproofing works

- Ceramics and natural stone works

- Aluminium works, steel works, and fabrications

- Lift and elevator installation,

- Partitioning and ceiling installation.

- Woodwork and furniture making

- Construction and installation of fences and security systems

19 Quarrying and mining

- Manufacturing of construction materials and components

- Saw milling and wood treatment

- Gemstone cutting, processing of gems, and precious stones.

- Mining and semi-permeable stones and materials

Also Read: Why Senior School Fees Will Vary and How Parents Will Pay

PART II-Textiles

- Extraction of Fibres (plant, synthetic, animal, blended).

25 Spinning, knitting, Weaving, embroidery

26 Textiles and apparel making

- Dyeing and printing

- Hides and skins processors.

- Leather processing.

- Leather products manufacturing

- Dry-cleaning.

- Footwear manufacturing

- Handbags, wallets, purses making

- Extraction of Fibres (plant, synthetic, animal, blended):

PART II-Mechanical Engineering

- Assemblers

36 Crankshaft grinding.

- Panel beating and spray painting

- General repair and maintenance

39 Metal works

- Containers and tanks

- Garages.

- Lift assemblers and maintenance firms

- Body builders

- Spare parts manufacturing, reconditioning, or engraving

- Steel plants, steam boilers, and gas installation

46 Refrigeration and air conditioning

- Fuel pump installation

- Highway control materials

PART IV-Electrical Engineering

- Power generation, installation, and distribution

- Electrical and electronic equipment

- Telephone equipment wiring, installation, and maintenance

- Electrical rewinding and repairs.

- Alarm, closed-circuit television, and electric fencing installation,

54 Air conditioning, refrigeration, and ventilation.

- Electrical communication, installation, fitting, and wiring.

56 Lift installation and elevators.

- Electronic communication installation

- Computer engineering installation, repar, and maintenance

59 Software development.

- Network and fibre installation

- Medical and laboratory equipment installation

- Electrical works, installation fitting and wiring

- Air conditioning works.

PART V-Food and Agriculture

- Pre-packaged foods

65 Fresh fruits and vegetables

66 Rowers and ornamentals

- Abattoirs and meat processing

- Bulk food processing

- Animal feeds.

- Fish or seafood products

- Jaggeries

- Coffee or tea processing

- Bakeries, confectioners, and food compounders

- Millers

- Seed manufacturing and plant propagation.

- Tobacco and related products.

PART VI- Chemicals

- Petroleum, gas, coal, and related products.

- Water treatment and filtration works.

- Agricultural chemicals and fertilizers, and re-packing of the same.

- Paint and solvents.

- Pulp, paper, and paper products.

- Organic and inorganic chemicals and compounds

- Glass products.

- Rubber.

- Adhesives.

86 Polishes and waxes

- Polymer and polymer products

88. Cinematography photographic studios

- Cosmetics and beauty products

- Pharmaceuticals and medical devices

- Advertising and sales promotion material design and production.

- Printing, publishing, and screen printing

- Soaps, detergents, bleaches, and disinfectants.

- Ceramics

- Medical, analytical, and industrial gas

“The list above is for guidance purposes only and is not to be construed to override the definition in Section 2 of the Act. Those concerned are advised to seek further clarification, information, and assistance from KEBS, Levy Section,” KEBS said.

KEBS notice to all manufacturers published on November 4, 2025. PHOTO/MyGov.