Share

The Kenya Revenue Authority (KRA) has issued a fresh directive to all petroleum retailers, reminding them to fully implement the electronic Tax Invoice Management System (eTIMS) for fuel stations ahead of the December 31, 2025, compliance deadline.

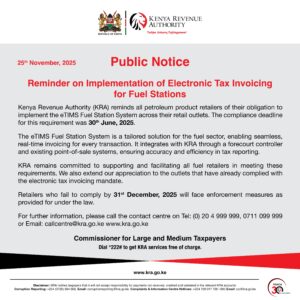

In a public notice dated November 25, 2025, KRA stated, “Reminder: e-Invoicing for Fuel Stations. Kenya Revenue Authority (KRA) reminds all petroleum retailers to implement the eTIMS Fuel Station System at their outlets.”

According to the tax authority, the mandatory system is designed to streamline real-time invoicing and ensure every fuel transaction is automatically captured and transmitted for accurate tax reporting.

The notice emphasized that the earlier compliance deadline of June 30, 2025, had already elapsed.

KRA added, “This real-time invoicing solution integrates with forecourt controllers and POS systems to ensure accurate tax reporting.”

Also Read: PPP Disclosure Raises Fresh Questions Over Nairobi–Nakuru Highway Project

System Integration and Purpose

In its detailed public statement, the authority said the eTIMS Fuel Station System is specifically built for the petroleum sector.

The system links fuel pumps, point-of-sale devices, and KRA’s digital tax platform to eliminate manual reporting gaps.

The system is expected to enhance transparency, reduce revenue leakages, and improve efficiency for both retailers and the government.

KRA further explained, “The eTIMS Fuel Station System is a tailored solution for the fuel sector, enabling seamless, real-time invoicing for every transaction.”

Compliance Status and Support Measures

KRA acknowledged that several petroleum outlets had already adhered to the directive and thanked them for leading the transition.

The agency reaffirmed its readiness to help fuel stations yet to comply, stating that it remains committed to providing technical and operational support.

“We thank outlets that have complied and remain committed to supporting all retailers in meeting these requirements,” the authority said.

Officials noted that support is available through KRA’s contact centre, which can be reached via 020 4 999 999, 0711 099 999 or email at callcentre@kra.go.ke.

Also Read: Explainer: What It Takes to Become an MCA in Kenya and Their Roles

Enforcement to Begin After December 31

Fuel stations that fail to implement the eTIMS Fuel Station System by December 31 will face penalties as outlined in Kenyan tax laws.

KRA warned that enforcement action will be applied strictly to non-compliant retailers.

In closing, KRA issued a standard reminder to taxpayers, noting that it will not bear responsibility for any unreceived or unvalidated payments made outside official channels.

The authority stated, “Retailers who remain non-compliant by 31st December 2025 will face enforcement action as provided by law.”

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

A Notice by KRA Issuing New Directive to All Fuel Stations. PHOTO/ KRA X

You Might also Like