How Cytonn CEO Inspired Aliko Dangote to go after a Corrupt Regulator

Share

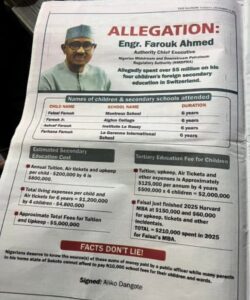

Nigerian billionaire Alhaji Aliko Dangote has published full-page advertisements in all the Nigerian newspapers accusing Eng. Farouk Ahmed, the Chief Executive Officer of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMPDPRA), of corruption and business sabotage.

Dangote, Africa’s richest man, has decried and complained of what he describes as systematic sabotage of the business community in Nigeria by public officials.

In his latest rant, he specifically singled out Eng. Farouk, alleging that the pioneer regulator and CEO of NMPDPRA has used his position for personal benefit at the expense of legitimate businesses.

Allegations of Living Beyond Known Means

In the adverts, Dangote accused Ahmed of living far beyond his known means.

He alleges that despite having a declared net worth of USD 300,000, Ahmed spent more than USD 7million in school fees for his four children in elite European institutions.

He also threatened to hold weekly press briefings every Wednesday until the matter is resolved.

“The position that Chairman Dangote has taken is not uncommon, but it underscores his determination to pursue the issue publicly. Across Africa, there are many rogue regulators and tax administrators, and it is always important to call them out, even though the cost may be steep, as corruption is known to fight back,” Samuel Karanja, a market Analyst at Woodstock Bridge, said.

Also Read:Nigeria Declares Emergency, Orders Massive Security Recruitment

Petition Filed with Anti-Corruption Agency

Dangote has also since has filed a formal petition with the Independent Corrupt Practices and Other Related Offences Commission (ICPC) against Farouk.

The petition, which was submitted on December 16, requests the arrest, investigation, and prosecution of Farouk for allegedly living beyond his means as a public official.

In the petition, Dangote claims that Farouk spent over USD 7 million over six years on his four children’s education in Switzerland, without lawful income to justify such expenditure.

He provided the names of the children, the schools they attended, and the amounts paid to support his allegations.

The petition further accuses Farouk of diverting public funds for personal gain.

These claims have fueled public debates and recent public outcry and protests in Nigeria.

Business Leaders Versus Regulators: A Global Pattern

While the jury is out on whether business leaders should publicly confront their regulators, global precedents show that such confrontations are not uncommon.

In several jurisdictions, business communities have, when pushed to the brink, taken regulators to court and into the court of public opinion in protracted and often bitter battles.

Closer to home in Kenya, similar high-profile confrontations have played out.

Edwin Dande vs Capital Markets Authority

Among the most notable is the case involving Cytonn Investments Managing Director Edwin Dande and the Capital Markets Authority (CMA), then led by CEO Wyckliffe Shamiah.

In 2021, the highly litigious Dande sued the CMA, accusing the regulator of acting in bad faith.

The legal action followed the CMA’s earlier decision to sanction a criminal probe into two Cytonn-managed funds: Cytonn High Yield Solutions (CHYS) and Cytonn Real Estate Projects Notes LLP (CPN).

Over the years, Dande engaged in multiple legal battles with the CMA, including public and online spats with Shamiah.

These rulings helped shape capital markets jurisprudence in Kenya and emboldened other corporate leaders to publicly challenge regulatory authority and alleged overreach.

Safaricom vs Communications Authority

In January 2022, Kenya’s leading telecom operator, Safaricom, filed a petition against the Communications Authority of Kenya (CA) following the regulator’s decision to slash the mobile termination rates (MTR) charge in the country to Sh0.12 ($0.0011) per minute.

Also Read: Benin Soldiers Seize Control, Remove President From Power

Guru Raval and the Competition Authority of Kenya

Back in 2020, at the height of the COVID-19 pandemic, the Competition Authority of Kenya (CAK), led by then Director General Francis Wangombe Kariuki, launched investigations into steel manufacturers, including Devki Steel Mills owned by Narendra “Guru” Raval.

Following dawn raids and seizure of electronic evidence under Anton Piller orders, CAK imposed fines of Ksh 46 million for collusion and price fixing.

Guru Raval and other penalized firms challenged the decision at the Competition Tribunal on procedural and legal grounds.

In September 2025, the tribunal ruled in favour of CAK, affirming its investigative powers and ordering steel manufacturers to implement competition compliance programs, even as public attention remained firmly fixed on Raval.

When Regulation Fails to Ease Consumer Pain

Other notable cases include Majid Al Futtaim Hypermarkets Limited v Competition Authority of Kenya, involving allegations of abuse of buyer power against Carrefour, and Regus Kenya Limited v the Data Protection Commissioner, following a Ksh 5 million fine for non-compliance with data protection laws.

“These cases highlight when regulators’ actions are deemed unreasonable, procedurally unfair, or beyond their statutory powers,” said Joseph Kihanya, a High Court Advocate of Kenya.

“Yet ask any Kenyan household about food or construction prices. Few will say they dropped after these rulings. The sanctions did not translate into cheaper groceries or affordable steel rods. The legal victory remained a technical story, confined to court reports and press releases,” Kihanya concluded.

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

Allegations of Corruption by Aliko Dangote on Farouk Ahmed in Nigeria.