Banks Propose 5% PAYE Cut and 30% Top Rate Cap

Share

The Kenya Bankers Association (KBA) has proposed a 5% reduction in Pay As You Earn (PAYE) tax across all bands and recommended capping the top rate at 30% to boost economic growth.

In a statement, KBA said it supports the decision by President William Ruto to exempt Kenyans earning up to Ksh 30,00 from PAYE deductions.

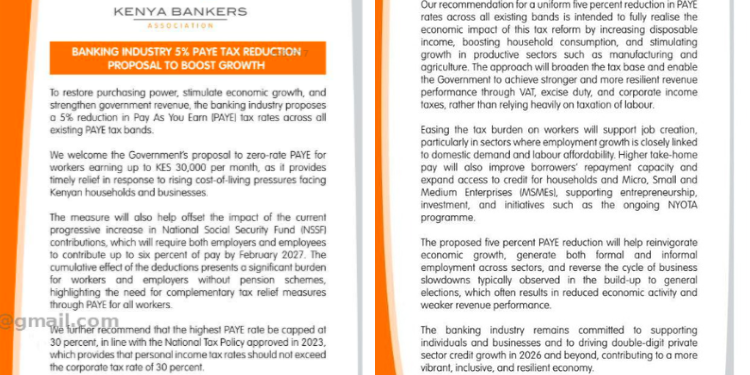

“To restore purchasing power, stimulate economic growth, and strengthen government revenue, the banking industry proposes a 5% reduction in Pay As You Earn (PAYE) tax rates across all existing PAYE tax bands,” KBA said.

“We welcome the Government’s proposal to zero-rate PAYE for workers earning up to Ksh 30,000 per month, as it provides timely relief in response to rising cost-of-living pressures facing Kenyan households and businesses.”

KBA explained that the measure will also help offset the impact of the current progressive increase in National Social Security Fund (NSSF) contributions, which will require both employers and employees to contribute up to six percent of pay by February 2027.

The Association said the cumulative effect of the deductions presents a significant burden for workers and employers without pension schemes, highlighting the need for complementary tax relief measures through PAYE for all workers.

Kenya Bankers Association Suggest 30% Cap

Further, KBA has recommended that the highest PAYE rate be capped at 30 percent, in line with the National Tax Policy approved in 2023, which provides that personal income tax rates should not exceed the corporate tax rate of 30 percent.

“Our recommendation for a uniform five percent reduction in PAYE rates across all existing bands is intended to fully realise the economic impact of this tax reform by increasing disposable income, boosting household consumption, and stimulating growth in productive sectors such as manufacturing and agriculture,” KBA added.

Also Read: Safaricom Announces Improved Interim Dividend as Shareholders Get Higher Payout

Broadening the Tax Base

It stated that the approach will also broaden the tax base and enable the Government to achieve stronger and more resilient revenue performance through VAT, excise duty, and corporate income taxes, rather than relying heavily on taxation of labour.

KBA said easing the tax burden on workers will support job creation, particularly in sectors where employment growth is closely linked to domestic demand and labour affordability.

Also Read: Del Monte Loses Ksh 1.76 Billion Tax Battle Against KRA

Improved Cash Flow and Economic Growth

The Association said higher take-home pay will also improve borrowers’ repayment capacity and expand access to credit for households and Micro, Small and Medium Enterprises (MSMEs), supporting entrepreneurship, investment, and initiatives such as the ongoing NYOTA programme.

“The proposed five percent PAYE reduction will help reinvigorate economic growth, generate both formal and informal employment across sectors, and reverse the cycle of business slowdowns typically observed in the build-up to general elections, which often results in reduced economic activity and weaker revenue performance,” KBA said.

KBA said the banking industry remains committed to supporting individuals and businesses and to driving double-digit private sector credit growth in 2026 and beyond, contributing to a more vibrant, inclusive, and resilient economy.

Follow our WhatsApp channel for Instant News Updates

KBA said it supports the decision by President William Ruto to exempt Kenyans earning up to Ksh 30,00 from PAYE deductions. PHOTO/Nation Screengrab.

You Might also Like