Central Bank Opens Ksh20 Billion Switch Auction

Share

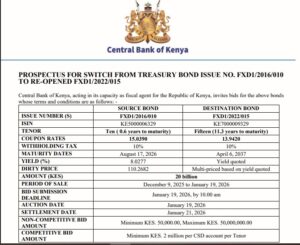

Republic of Kenya’s fiscal agent, the Central Bank of Kenya (CBK) has released a prospectus for a switch auction in which qualified investors can swap their holdings in an expiring Treasury for a longer-term reopened issue.

According to the report by the Central Bank of Kenya on December 9, 2025, the total amount targeted for the switch is KES 20 billion in a move aimed at extending the government’s debt maturity profile.

The Central Bank is inviting investors to switch from the shorter-term Treasury Bond FXD1/2016/010, which has only 0.6 years to maturity (August 17, 2026) and a 13.9420% coupon rate.

In return, they will receive the re-opened FXD1/2022/015 bond, which significantly extends their maturity to April 6, 2037 (11.3 years remaining) and provides a higher coupon rate of 15.0390%.

The Central Bank outlined the eligibility, stating that participation is voluntary.

Only investors with unencumbered holdings in the source bond, FXD1/2016/010, as of the auction date, January 19, 2026, will be eligible to participate.

“Only investors with unencumbered holdings in Treasury bond issue number FXD1/2016/010 as at January 19, 2026. Participation in the auction is on a voluntary basis, and investors may opt to switch part or the entire holding (face value) in the bond,” a part of the CBK report reads.

Also Read: https://hivileo.co.ke/2017/03/23/koskei-urges-risk-based-audits-to-curb-misuse-of-public-funds/

The report further stated that on the day of the auction, successful bidders will receive allocation results through the DhowCSD Investor Portal or App.

Any money that remains below the minimum investment threshold will be reimbursed on settlement day.

“All successful bidders should obtain details of amounts allocated from the DhowCSD Investor Portal/App under the Bids tab on Monday, January 19, 2026. The Central Bank reserves the right to accept applications in full or part thereof or reject them in total without giving any reason,” the CBK report continues.

Successful investors’ portfolios will be updated with the allocated amounts and any remaining cash below the minimum investment amount of KES. 50,000.00 refunded to investors on Wednesday, January 21, 2026.

Also Read: https://hivileo.co.ke/2025/11/26/kenya-secures-another-loan-from-china-eximbank/

Further, the bonds qualify for statutory liquidity ratio requirements for Commercial Banks and Non-Bank financial institutions as stipulated in the Banking Act, CAP 488 of the laws of Kenya.

“The bonds qualify for statutory liquidity ratio requirements for Commercial Banks and Non-Bank financial institutions as stipulated in the Banking Ac,t CAP 488 of the laws of Kenya,” CBK Report stated.

It added, “Investors with outstanding pledges need to cancel those five (5) days before the switch value date to be eligible to participate in the switch auction.”

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

CBK report released on December 9, 2025. PHOTO/Screenscrab by Hivileo