Share

The Kenya Revenue Authority (KRA) has unveiled a list of reportable jurisdictions in relation to the Common Reporting Standards (CRS) rules.

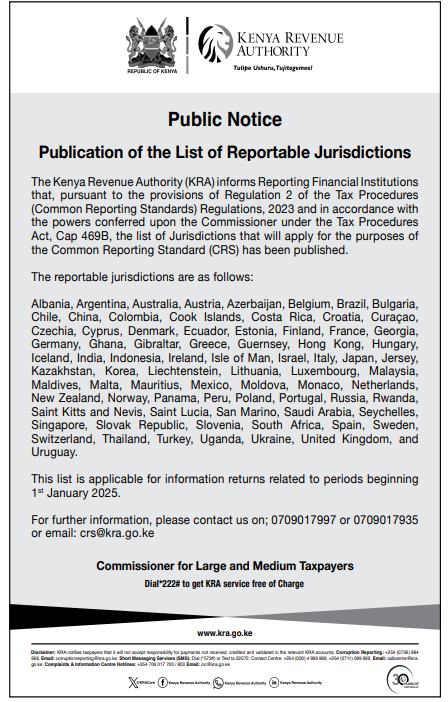

In an official public notice released on December 18, 2025, KRA stated that the list of jurisdictions relevant for the application of the Common Reporting Standard (CRS) has now been made public.

KRA added that they utilized the powers conferred upon them under the new CRS Regulations 2023 to complete the process.

“The Kenya Revenue Authority (KRA) informs Reporting Financial Institutions that, pursuant to the provisions of Regulation 2 of the Tax Procedures (Common Reporting Standards) Regulations, 2023 and in accordance with the powers conferred upon the Commissioner under the Tax Procedures Act, Cap 469B, the list of jurisdictions that will apply for the Common Reporting Standard (CRS) has been published,” read part notice.

Also Read: KRA Issues New Directive to All Fuel Stations

What Are Reportable Jurisdictions

The reportable jurisdictions applicable for compliance and information exchange under the Common Reporting Standard are listed below, as designated in accordance with the relevant regulatory and statutory provisions includes:

Albania, Argentina, Australia, Austria, Azerbaijan, Belgium, Brazil, Bulgaria, Chile, China, Colombia, Cook Islands, Costa Rica, Croatia, Curacao, Czechia, Cyprus, Denmark, Ecuador, Estonia, Finland, France, Georgia, Germany, Ghana, Gibraltar, Greece, Guernsey, Hong Kong, Hungary, Iceland, India, Indonesia, Ireland, Isle of Man, Israel, Italy,

Other reportable jurisdictions comprises of: Japan, Jersey, Kazakhstan, Korea, Liechtenstein, Lithuania, Luxembourg, Malaysia, Maldives, Malta, Mauritius, Mexico, Moldova, Monaco, Netherlands, New Zealand, Norway, Panama, Peru, Poland, Portugal, Russia, Rwanda, Saint Kitts and Nevis, Saint Lucia, San Marino, Saudi Arabia, Seychelles, Singapore, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, Uganda, Ukraine, United Kingdom, and Uruguay.

Also Read: KRA Launches New Automated Payment System: How it Works

When Will be Reporting Period

Additionally, this list shall apply to information returns for reporting periods commencing on 1st January 1st, 2025.

“This list is applicable for information returns related to periods beginning 1st January 2025,” KRA stated.

Follow our WhatsApp Channel and WhatsApp Community for instant news updates

KRA lists reportable jurisdictions. PHOTO/KRA X

You Might also Like