Share

According to Business Registration Service, the economy of Kenya is facing vulnerability due to money laundering.

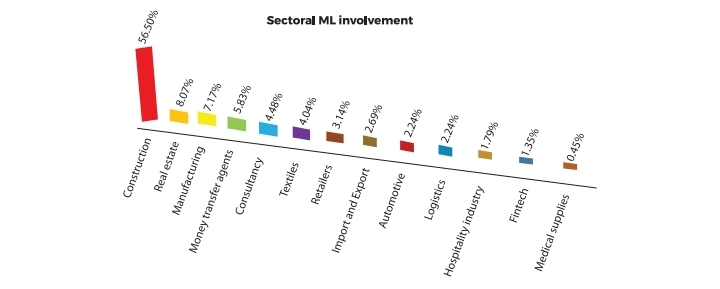

This gradual change has been impacted by construction of industries serving as the biggest hotspot of reported cases.

Business Registration Service data shows that the industry sector accounts for around 56.50% of the reported cases, therefore it highlights drastic growing concerns over illicit financial activities.

Data shows construction being dominant, other sectors are also centers of money laundering activities.

Real state takes the second position contributing to 8.07% of money laundering activities. It is followed by manufacturing taking the third position with 7.17% money laundering activities.

Another key part of Kenya’s vibrant financial system, Money transfer agents also come at the fourth-place accounting for 5.83% of cases.

Consultancy service follows closely at fifth place contributing to 4.48% while textile industry and retail sector, though relatively smaller players, still record 4.04 percent and 3.14 percent respectively.

Import and export amounts at 2.69% while automotive has 2.24%. Logistics, hospitality industry, Fintech and Medical supplies amounts at 2.24%, 1.79%, 1.35% and 0.45% respectively.

Dominance of construction in these statics shows how the sector experiences a heavy cash flow throughout with excessive opaque transactions. Large amount of money can be hidden in projects.

Real estate sector also continues the trend of motivating and allowing illicit funds to be converted into tangible assets and masking the originality of money.

Manufacturing highlights how the sector is slowly squandering money with money transfer agents coming closely.

Money laundering becomes a big threat to Kenya’s economy which becomes impossible to safeguard investments and restore public trust in key sectors of the economy.

The main challenges facing authorities investigating cross border money laundering crimes which could prevent authorities from pursuing complex investigations involving certain legal structures included conflict of laws, lack of cooperation and collaboration between LEAs in various jurisdictions and the complex nature of MLA processes.

Review of the enforcement data shows that Private Limited Companies were the most frequently abused legal structure for money laundering purposes in Kenya in comparison to other legal structures.

Trusts did not feature prominently in enforcement data analysed. However, there is a likelihood of abuse for ML purposes due to the absence of a robust legal regime governing trusts and inadequate supervision and regulation.

Money Laundering chart from highest to lowest. PHOTO/ BRS Screenshot