Kenya Prices USD 2.25 Billion Eurobond, Targets 2028 & 2032 Notes

Share

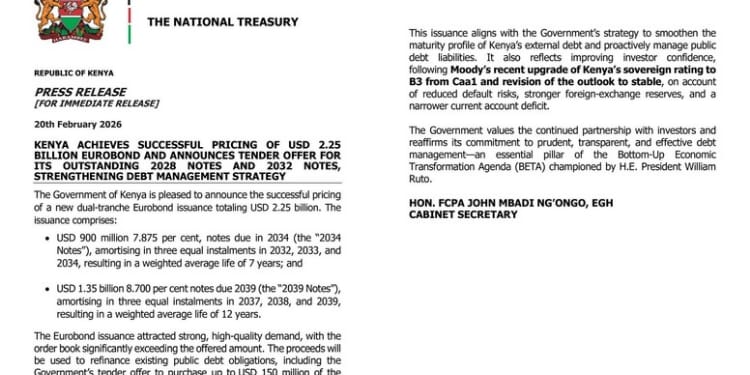

The Government of Kenya has announced the successful pricing of a new dual-tranche Eurobond issuance totaling USD 2.25 billion.

In a statement, Treasury CS John Mbadi said the issuance comprises:

- USD 900 million 7.875 per cent, notes due in 2034 (the “2034 Notes”), amortising in three equal instalments in 2032, 2033, and 2034, resulting in a weighted average life of 7 years; and

- USD 1.35 billion 8.700 per cent notes due 2039 (the “2039 Notes”), amortising in three equal instalments in 2037, 2038, and 2039, resulting in a weighted average life of 12 years.

Mbadi said the Eurobond issuance attracted strong, high-quality demand, with the order book significantly exceeding the offered amount.

“The proceeds will be used to refinance existing public debt obligations, including the Government’s tender offer to purchase up to USD 150 million of the outstanding 7.250 per cent Notes due in February 2028 and up to USD 350 million of the outstanding 8.000% Notes due in May 2032 (in both cases inclusive of accrued interest). Any remaining proceeds will support general budgetary needs. Tender offer results will be announced on 26th February 2026,” Mbadi said.

Also Read: Kenya Secures Ksh193 Billion in New Eurobond Loan

Eurobond Issuance Reflection

Further, the CS said the issuance aligns with the Government’s strategy to smooth the maturity profile of Kenya’s external debt and proactively manage public debt liabilities.

Mbadi said the Eurobond issuance reflects improving investor confidence.

He said Moody’s recently upgraded Kenya’s sovereign rating to B3 from Caa1.

Also Read: Relief in Sight as Banks Call for 5% PAYE Cut Across All Tax Bands

He added that the outlook was revised to stable due to reduced default risks, stronger foreign-exchange reserves, and a narrower current account deficit.”

“It also reflects improving investor confidence, following Moody’s recent upgrade of Kenya’s sovereign rating to B3 from Caa1 and revision of the outlook to stable, on account of reduced default risks, stronger foreign-exchange reserves, and a narrower current account deficit,” the CS said.

He stressed that the Government values the continued partnership with investors and reaffirms its commitment to prudent, transparent, and effective debt management-an essential pillar of the Bottom-Up Economic Transformation Agenda (BETA) championed by President William Ruto.

Follow our WhatsApp Channel for Instant News Updates

The Government of Kenya has announced the successful pricing of a new dual-tranche Eurobond issuance totaling USD 2.25 billion. PHOTO/Kiptoo X.

You Might also Like